A 2015 study surveyed Canadian citizens about their financial attitude during the months of June to September and found that a huge majority of people adopt carefree spending habits during the summer. A quick summary of the study stated that people are more willing to dish out for food and drinks while on vacation and that one in five Canadians are likely to book summer vacations using credit or going into debt.

We see the same trend here in the Philippines with flight promos and summer sales cleaning out our wallets. It is more apparent for parents as they spend heavily for their family trips. For parents who want to teach their kids the value of money, summer is the best time to start encouraging financial awareness.

“It is never too early to start teaching your kids about investing,” says Michelle Villanueva Head of Products and Marketing at Philam Asset Management, Inc. (PAMI) “If we follow the idea of starting small and thinking big we will find that in time our children will grow to become a more financially savvy generation. After all, we want to raise adults not kids.”

Villanueva explains that setting the stage with saving their allowances using the 50/20/30 rule, where you allocate 50% of your salary to essentials, 20% to your savings account, and 30% to your personal expenses, opens the doorway into investing. “Kids will find that their savings over a year, no matter how small, were a result of their efforts and choices. This is when parents should introduce the basic concepts of investing”.

Establishing good behaviour and sound financial habits will not be easy but it will be a fruitful experience for both you and your kids. Here are some key tips to ensure your child’s financial wellness in the future.

- Educate- You will find many useful resources such as Investopedia or PAMI’s fund filled infographics on philamfunds.com that simplify investing jargons with fun and easy to understand visuals.

- Instill a consistent investing behaviour- This simple lesson about long-term investing sets the stage for your child’s understanding on what it really takes to make their money grow. Parents can teach their kids about Cost Averaging and Contrarian Investing.

- Teach in their style- Children ages 5-6 years old typically can attend to one activity that is of interest to them for around 10-15 minutes at a time. Make the most of it by knowing their learning style. You can observe or ask their teachers. Once you are sure, fit your conversations into that.

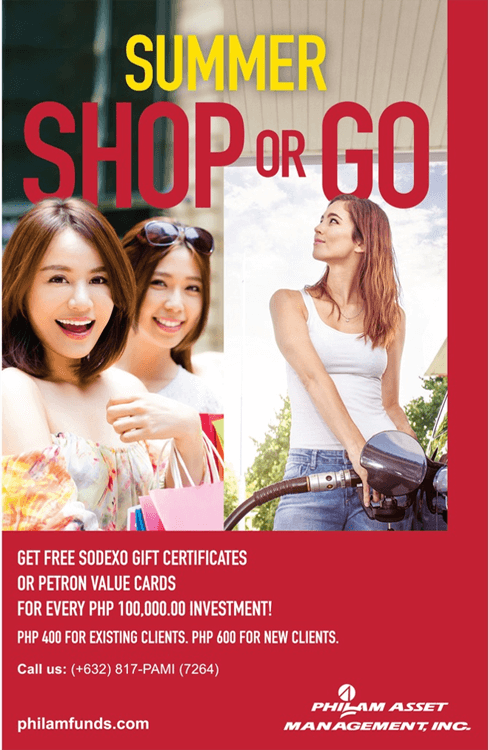

Parents must truly make use of the summer season to influence their child’s financial awareness. They can make it even more exciting with PAMI’s Summer Shop or Go Promo which rewards new investors with a prize of their choosing between Sodexo gift certificates and Petron Value Cards. Show your child the importance of investing and enjoy the additional perks that go with it.

6 Responses

This is so insanely important! I wish my parents taught me this at a young age, or perhaps they tried to…. But I was too stubborn!

Seldom of the parents from yesteryears teaches kids the value of investing.. but todays parents i think consider this already and i am one of them

It’s a good idea to teach kids how to invest even at their young age, this lays a foundation for good financial habits as they grow old.

In so doing kids are trained to appreciate, treat the importance of feasible investment. Kids are still in the verge of being educated because of their young mind

I think if kids learn savings at an early age, it would be a habit to them. They can really earn a lot with a little discipline.

Millionaires game was one of the board games I played as a child that taught me the value of investing! Great tips you shared here, practical application and approach always works IMHO.